The Greek debt is unpayable. It is simply too large to be repaid. The austerity that the EU and IMF have imposed on Greece has…

Greek government-debt crisis

All over the planet, large banks are massively overexposed to derivatives contracts. Interest rate derivatives account for the biggest chunk of these derivatives contracts. According to…

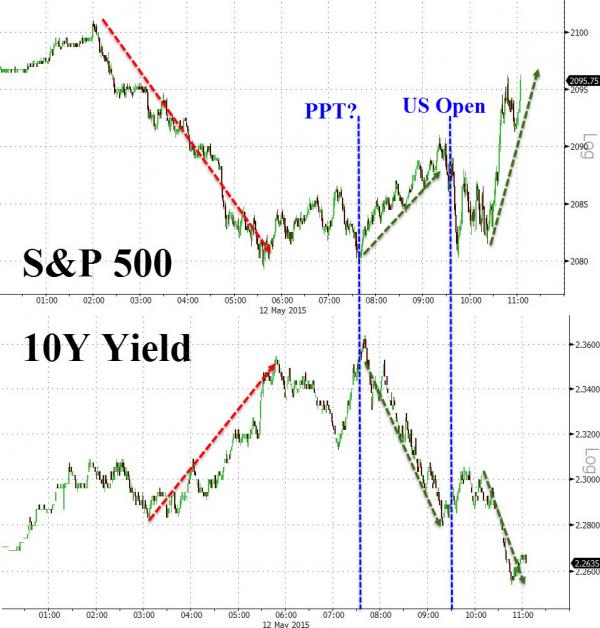

That didn’t take long did it? I of course am speaking of the second overnight and global meltdown of the credit markets …in the last…

World finance officials said Saturday they see a number of threats on the horizon for a global economy still clawing back from the deepest recession…

We seem to have finally arrived at some sort of moment of truth regarding Greece and their inclusion in the EU. The speculation is they will…

Greek ministers are spending this weekend, almost five grinding years since Athens was first bailed out, wrangling over the details of the spending cuts and…