Financial penalties expected to hit British banks for Forex rigging will do little to tackle financial crime in the City of London as regulators continue to prioritize high finance over ordinary citizens, experts warn. British banks could be fined billions in coming months as investors pursue them for rigging foreign exchange (Forex) rates, following a landmark US settlement on Friday. …

Pratap Chatterjee – “Project Omega” Reveals Secrets Of Dark Pools Stock Trading

Investment Technology Group (ITG), a U.S. stock broker, paid a $20.3 million fine for running a secret operation named Project Omega to take advantage of “dark pools” trading orders made by its clients. Experts say that Barclays and Credit Suisse may also soon pay fines for dark pools trading scams.Most traders buy and sell stocks on public stock exchanges – …

Rory Hall – Something Is Broken In The Gold And Silver Markets

Earlier today I was speaking with Dave Kranzler and we fell into a discussion regarding the current state of gold and silver. This is how I described everything to Dave as we talked: Beginning in December, as Dave pointed out in Is The Global Financial System On The Brink Of Collapse?, something happened in the derivatives market and I believe …

Is Gold Really Manipulated? Or, Are You Being Manipulated? – Avi Gilburt

The most common complaint I now hear as to why many are fearful of investing in precious metals is that they feel they have been “manipulated to go down.” While many investors have been scared into believing this perspective by many market pundits as the metals have dropped, I am hoping that investors would maintain an open mind about the …

Aspirational parents condemn their children to a desperate, joyless life – George Monbiot

Perhaps because the alternative is too hideous to contemplate, we persuade ourselves that those who wield power know what they are doing. The belief in a guiding intelligence is hard to shake. We know that our conditions of life are deteriorating. Most young people have little prospect of owning a home, or even of renting a decent one. Interesting jobs …

When Is a Felony Not a Felony? When You Are a Bank – Alexis Goldstein

Good news, America: We can now get guilty pleas from banks! Bad news, America: That’s only because guilty pleas from banks are now absolutely meaningless. Last week, JP Morgan, Citigroup, Barclays, and Royal Bank of Scotland pled guilty to felony charges of conspiring to manipulate currency prices, and UBS pled guilty to manipulating benchmark interest rates. Regulators and prosecutors found …

The Big Banks Are Corrupt – And Getting Worse – Richard eskow

The Justice Department’s latest settlement with felonious big banks was announced this week, but the repercussions were limited to a few headlines and some scattered protestations. That’s not enough. We need to understand that our financial system is not merely corrupt in practice. It is corrupt by design – and the problem is growing. Let’s connect the dots, using news …

Latest Guilty Pleas Prove Big Bank Criminality ‘Rampant,’ But Jail Time Non-Existent – Deirdre Fulton

In the wake of Wednesday’s announcement that five global financial institutions have agreed to plead guilty to multiple crimes and pay about $5.6 billion in penalties for manipulating foreign currencies and interest rates, corporate watchdogs are reiterating the call to ‘break up the banks’ in light of their ongoing malfeasance. As with other recent settlements, Wednesday’s news provides further evidence to …

Deutsche Bank Pays $2.5 Billion Fine For Interest Rate Rigging – Pratap Chatterjee

Deutsche Bank has agreed to pay out a record $2.5 billion fine to settle U.K. and U.S. government investigations into allegations of fixing global interest rates, just months after six other banks paid out $4.3 billion on similar charges. Activists say that the banks should have faced criminal charges. “The question remains: does the punishment fit the crime?” writes Angela McClellan of …

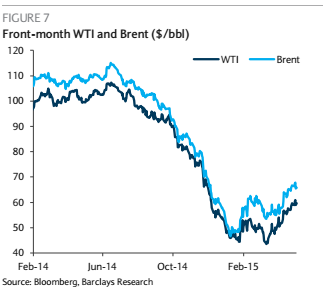

Big banks flag dangers of financial bubble in oil and commodities – Ambrose Evans-Pritchard

The big global banks have begun to warn clients that the blistering rally in oil and industrial commodities in recent weeks has run far ahead of economic reality, raising the risk of a fresh slump in prices over the summer. Barclays, Morgan Stanley and Deutsche Bank have all issued reports advising investors to tread carefully as energy and base metals …