Jack provides a brief overview of important developments in the global economy this past week, focusing on China. Renewed financial bubbles in real estate and rapidly slowing China exports that reflect a slowing global economy are discussed, as is the Asia region economy in general. The ‘canary in the Asian economy goldmine’, Singapore, recorded a -4.1% GDP contraction, as shipping sector indicators reveal a global economy and trade continuing to stagnate. Most of the show then focuses on the 2nd presidential debate of last week. Special attention is given to the comments by Clinton on the Russians—i.e. the declaration of alleged hacking of the Democratic party; the assertion that Russia is behind the recent Wikileaks revelations about Hillary’s ‘dual’ strategy (of saying one thing in closed meetings to business and bankers while another, sometimes opposite, to the general populace in her campaign); and her explicit statement in the debate the US should impose ‘no fly zones’ and commit US special forces to the conflict in Syria. Is the US sliding toward a direct confrontation with Russia in Syria? Does Hillary’s position represent the US war hawks’ re. Syria? Reading between the lines, the 2nd presidential debate appears to suggest so.

yler Durden – A Stunning Admission From Deutsche Bank Why A Shock Is Needed To Collapse The Market, And Force A Real Panic

In what may be some of the best, and most lucid, writing on everyone’s favorite topic, namely “what happens next” in the evolution of the financial system, Deutsche Bank’s Dominic Konstam, takes a look at the current dead-end monetary situation, and concludes that in order for the system to transition from the current state of financial repression, which has made a …

Climate Change Puts Trillions of Dollars of Assets at Risk: Study

Trillions of dollars of non-bank financial assets around the world are vulnerable to the effects of global warming, according to a study on Mondaythat says tougher action to curb greenhouse gas emissions makes sense for investors. Rising temperatures and the dislocation caused by related droughts, floods and heatwaves will slow global economic growth and damage the performance of stocks and bonds, …

CHRIS MARTENSON – The Return of Crisis: Everywhere Banks are in Deep Trouble

Financial markets the world over are increasingly chaotic; either retreating or plunging. Our view remains that there’s a gigantic market crash in the coming future — one that has possibly started now. Our reason for expecting a market crash is simple: Bubbles always burst. Bubbles arise when asset prices inflate above what underlying incomes can sustain. Centuries ago, the Dutch woke …

Peter Koenig – Are EU Country Central Banks “Illegally” Buying Government Bonds?

The following text is an English transcript (translation) of an RT Berlin Interview in German regarding an apparent secret agreement between the European Central Bank (ECB) and individual Euro countries’ central banks issuing large amounts of government bonds. The discovery flared up just before the FED raised its base interest rate by a quarter percent on 16 December 2015, signalling the …

Gaither Stewart – One Of History’s Greatest Mass Migrations Of Peoples

Europe, the small tail end peninsula of the great Euro-Asian land mass, gears up to receive the brunt of a mass migration of peoples from the South and East fleeing from the wars raging in their worlds. The United Nations Refugee Agency predicts some 800,000 arrivals of “seekers of asylum” in the remaining months of 2015. Estimates of the numbers …

Global Trade War US/EU Against BRICS By James Hall

Do not be confused. Globalists whether Wall Street capitalists, corporatists, collectivist authoritarians or devoted internationalists, all share a common mindset – a worldwide financial system must control commerce and dictate economic activity. Under this formula, trade has little to do with free market transactions. Monopolies are the rule and real competition is fatal. So when the financial press emphasizes the …

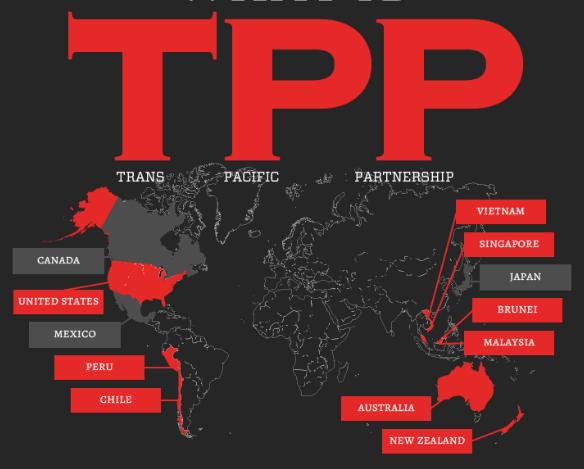

WikiLeaks Releases Section of Secret Trans-Pacific Partnership Agreement That Would Affect Health Care – KEVIN GOSZTOLA

WikiLeaks has released a draft of an annex of a secret Trans-Pacific Partnership trade agreement, which would likely enable pharmaceutical companies to fight the ability of participating governments to control the rise of drug prices. It would empower companies to mount challenges to Medicare in the United States. For a number of years, the US and eleven other countries—Australia, Brunei, …

Governments Giving Fossil Fuel Companies $10 Million a Minute: IMF – Nadia Prupis

The fossil fuel industry receives $5.3 trillion a year in government subsidies, despite its disastrous toll on the environment, human health, and other global inequality issues, a new report by the International Monetary Fund (IMF) published Monday has found. That means that governments worldwide are spending $10 million every minute to fund energy companies—more than the estimated public health spending …

Trans-Pacific Partnership versus National Sovereignty: A False Dilemma – Dr. Glen T. Martin

We are faced here with a terrifying false dilemma because we refuse to recognize the bigger picture that includes the history of capitalism in relation to the system of sovereign nation-states. In the past several decades, the globalization inherent in capitalism has gone off the charts in its drive to colonize the entire world economy in the service of private …