Although stocks bounced back on “Turnaround Tuesday” on the belief that contagion has been contained following the rout that wiped out $3.6 trillion from equity markets following Great Britain’s referendum last Thursday to “Brexit” the European Union… we disagree. It’s bigger than Brexit. Despite many of the world’s largest hedge funds betting billions on a “Remain” victory and British bookies putting the chances of “Leave” at barely 10 percent, in our June 15 Trend Alert, we wrote, “Should the ‘Leave’ vote win, we forecast the US dollar and gold prices will spike while equity markets, particularly those currently under downward pressure, will sink deeply lower.” Since then, gold hit two-year highs, the British pound fell to 31-year lows and currencies around the world hit new lows against the US dollar – or tested old ones – as investors sought safe-haven assets such as the dollar and Japanese yen.

The criticism in the “investor” world has long been that gold yields no interest. However, as interest rates around the world keep trending lower and holding cash yields nothing, in a climate of ongoing market volatility, for many, holding gold is considered the ultimate safe-haven commodity.

It’s Our Money with Ellen Brown – You’ve Been Strip Mined! – 04.13.16

You’ve Been Strip Mined! That’s how Ellen’s guest Les Leopold describes what has happened to the constructive role of capital, such as investment in research and development, expansion and improvement of services and industries. He calls it “economic strip-mining” in which capital speculators like hedge funds strip the equity of companies, countries and consumers to feed their insatiable desire for short term profits – outcomes be damned. We also introduce the new national project and campaign called “What Wall Street Costs America” – the start of a national conversation revealing the massive extraction of public dollars by Wall Street interests. And Matt Stannard reviews presidential politics and bank reform on the Public Banking Report.

Alternative Visions – Rent Price Gouging and Grass Roots Resistance – 02.26.16

Jack welcomes local community organizers, Maria Marroquin, director of the Worker Day Center in Mt. View, California, and Gayle McLaughlin, former mayor and now city councilperson in Richmond, California, to explain the grass roots efforts underway in their cities today to resist and rollback skyrocketing rent prices. With apartment rents having risen 25%-30% the past two years, and wages either frozen or falling for working and middle class families, more are being displaced and forced to move out of their homes—often evicted unfairly and arbitrarily by apartment chain property owners owned by hedge funds and other big finance Wall St. organizations. Maria describes the efforts in progress in her city to unite forces to resist unjust evictions and stabilize rents by passing city ordnances giving renters some basic rights. Gayle describes how the Richmond Progressive Alliance in her city challenged and won majority seats on the city council and passed rent ordnances and how the California Apartment Association—the big business lobbying arm for multi-unit apartment owners—temporarily blocked the ordnance. Gayle describes the organizing underway today for an even better rent ordnance coming up this November. Jack offers suggestions how the various fragmented efforts need to unite and ‘march on Sacramento’ to force statewide rights for renters and stop the rent price gouging that is now out of control, much like pharmaceutical drugs and education price gouging.

For more information about events underway and planned in Richmond, go to: gayle@definingourdestin.net or richmondprogressivealliance.net website. For events in Mt. View go to mtviewtenantscoalition.org. Find out how successful resistance to rent gouging is done.

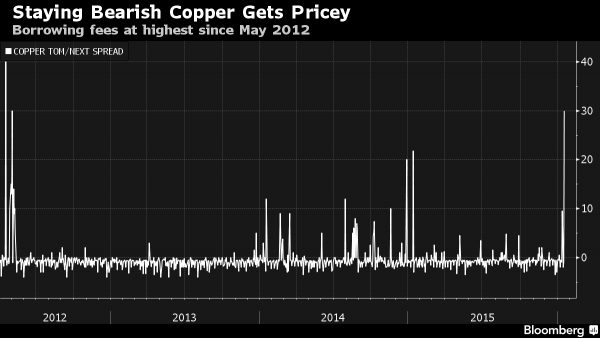

Someone Is Trying To Corner The Copper Market

It may not be as sexy as gold and silver, but sometimes even doctor copper needs a little squeeze and corner love as well, and according to Bloomberg, that is precisely what someone is trying to do. One company whose identity is unknown, is “hoarding as much as half the copper available in warehouses tracked by the London Metal Exchange.” …

Major Drug Distributors Flooded West Virginia with Millions of Pain Pills

One of the nation’s largest pharmaceutical drug wholesalers is under fire from West Virginia’s attorney general, Patrick Morrisey. On Friday, Morrisey announced a lawsuit against San Francisco-based McKesson Corporation alleging the company violated state consumer protection laws and the Uniform Controlled Substances Act by flooding West Virginia with tens of millions of prescription pills. McKesson allegedly failed to detect, report, …

Natalie Wolchover – A New Physics Theory of Life

Why does life exist? Popular hypotheses credit a primordial soup, a bolt of lightning, and a colossal stroke of luck. But if a provocative new theory is correct, luck may have little to do with it. Instead, according to the physicist proposing the idea, the origin and subsequent evolution of life follow from the fundamental laws of nature and “should …

Rishma Parpia – New Law Aims to Expose Big Pharma Influence on Physicians

Story Highlights Financial relationships between physicians and drug companies have existed for decades. Ties between doctors and the pharmaceutical industry have raised conflicts of interest concerns. The Physicians Payment Sunshine Act has stirred controversy around conflict of interest policies. It is no secret that the medical field is heavily influenced by the pharmaceutical industry. For many decades, health care professionals and …

Robert Reich – Of Rotten Apples and Rotten Systems

Martin Shkreli, the former hedge-fund manager turned pharmaceutical CEO who was arrested last week, has been described as a sociopath and worse. In reality, he’s a brasher and larger version of what others in finance and corporate suites do all the time. Federal prosecutors are charging him with conning wealthy investors. Lying to investors is illegal, of course, but it’s …

MARY ELIZABETH WILLIAMS – “Martin Shkreli is the Donald Trump of drug development”: Why even a biotech exec agrees Turing’s pill price-gouging is “even skeevier than you think”

“Martin Shkreli is the Donald Trump of drug development,” my friend Frank tells me. “He’s a hedge fund manager who gives hedge fund managers a bad name.” Frank — a chief scientific officer at a biotech company (and whose name has been changed to protect his and his family’s privacy) — is talking to me Tuesday morning, en route to …