The leading expert on food at the United Nations says sharp price fluctuations in the price of food has little to do with actual supply. Nowadays, rapacious out-of-control investment backs such as Goldman Sachs, Morgan Stanley and Barclays Capital now dominate food speculation through the commodities markets. They dwarf the amount traded by actual food producers and buyers needlessly tipping millions into …

Stop Paying Executives for Performance

For chief executives and other senior leaders, it is not unusual for 60-80% of their pay to be tied to performance – whether performance is measured by quarterly earnings, stock prices, or something else. And yet from a review of the research on incentives and motivation, it is wholly unclear why such a large proportion of these executives’ compensation packages …

It is worse than anyone thought on Wall Street

Daniel Pinto, CEO of JPMorgan’s corporate and investment bank, just made a gloomy prediction for Wall Street. He said that the firm’s investment-banking revenues are forecast to be down 25% in the first quarter. Markets revenues are down 20% year-on-year, Pinto said, speaking at JPMorgan’s Investor Day conference. Importantly, Pinto noted, the start to 2015 is a tough comparison period for markets revenues because …

JACK RASMUS – The Next Global Financial Fault Line

Global Equity Markets In the past year the stock markets in China erupted, contracting by nearly 50% in just three months, after having risen in the preceding year by 130%–truly a ‘bubble event’. That collapse, commencing in June 2015, continues despite efforts to stabilize it. Chinese bankers then injected directly $400 billion to stem the decline. Including other government and …

Trends This Week – False faith, not hard data, boosting markets. Can it last? – 02.17.16

Trend forecaster Gerald Celente lays it on the table, dissecting why the bounce back in markets the last few days is bunk. After equity markets worldwide suffered one of the worst starts of a new year in history, stocks suddenly rebounded. For example, the Nikkei closed out last week at its lowest level since October 2014. But what economic fundamentals spiked prices higher this week? Was it the dismal news that Japan’s economy contracted 1.4 percent in the last quarter? No. What boosted stocks prices was the twisted rationale that despite the Bank of Japan firing two rounds of blanks from its “monetary bazooka,” the lousy Gross Domestic Product number was cause to launch yet another round of stimulus. Before Chinese markets opened Monday after being closed for a week, the Shanghai Index had fallen 47 percent since its peak in June. Was it on the rotten news that China’s exports fell 11.2 percent in January and imports plunged 18.8 percent that markets rallied? No. As with Japan, the dismal data was taken as a positive sign that the People’s Bank of China would take bold measures to boost sluggish growth. “Confidence,” trust the effectiveness of the rigged market game, not economic fundamentals, was the rationale for stocks suddenly moving higher. Tuesday’s New York Times headline summed it up: “Global Shares Buoyed by Investor Faith.” Yes, faith in more failed central-bank stimulus and stock and bond buyback sideshows… not faith in true price discovery and robust Gross Domestic product growth.

Andrew Gavin Marshall – Bank Crimes Pay: Under the Thumb of the Global Financial Mafiocracy

On Nov. 13, the United Kingdom’s Serious Fraud Office (SFO) announced it was charging 10 individual bankers, working for two separate banks, Deutsche Bank and Barclays, with fraud over their rigging of the Euribor rates. The latest announcement shines the spotlight once again on the scandals and criminal behavior that have come to define the world of global banking. To date, only …

Jeff Thomas – From Crisis To Confiscation – Where Do I Store My Wealth?

International diversification of wealth (no matter how large or small) can save your economic freedom. Although most of our readers thoroughly understand this concept, one of the most oft-heard concerns is that, by offshoring assets, one may not be able to get to them as easily as they now can. Here’s the response to that, and some practical advice on …

Wall Street Front Group Pleads for Government Help in New York Times OpEd By Pam Martens and Russ Martens

If you live outside of New York City, you’ve never heard of the Partnership for New York City. Even if you live inside New York City, unless you’re part of the black tie cocktail circuit, you’ve still never heard of the group. So when the New York Times gave a chunk of its opinion pages on Monday to Wylde as …

Deutsche Bank Pays $2.5 Billion Fine For Interest Rate Rigging – Pratap Chatterjee

Deutsche Bank has agreed to pay out a record $2.5 billion fine to settle U.K. and U.S. government investigations into allegations of fixing global interest rates, just months after six other banks paid out $4.3 billion on similar charges. Activists say that the banks should have faced criminal charges. “The question remains: does the punishment fit the crime?” writes Angela McClellan of …

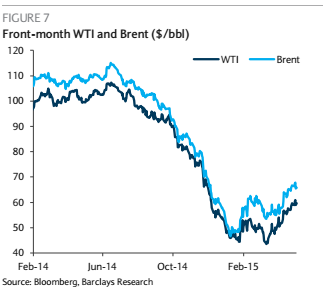

Big banks flag dangers of financial bubble in oil and commodities – Ambrose Evans-Pritchard

The big global banks have begun to warn clients that the blistering rally in oil and industrial commodities in recent weeks has run far ahead of economic reality, raising the risk of a fresh slump in prices over the summer. Barclays, Morgan Stanley and Deutsche Bank have all issued reports advising investors to tread carefully as energy and base metals …